Can’t-Miss Takeaways Of Info About How To Write A Family Budget

Table of content.

How to write a family budget. By rachel cruze. Setting financial goals.

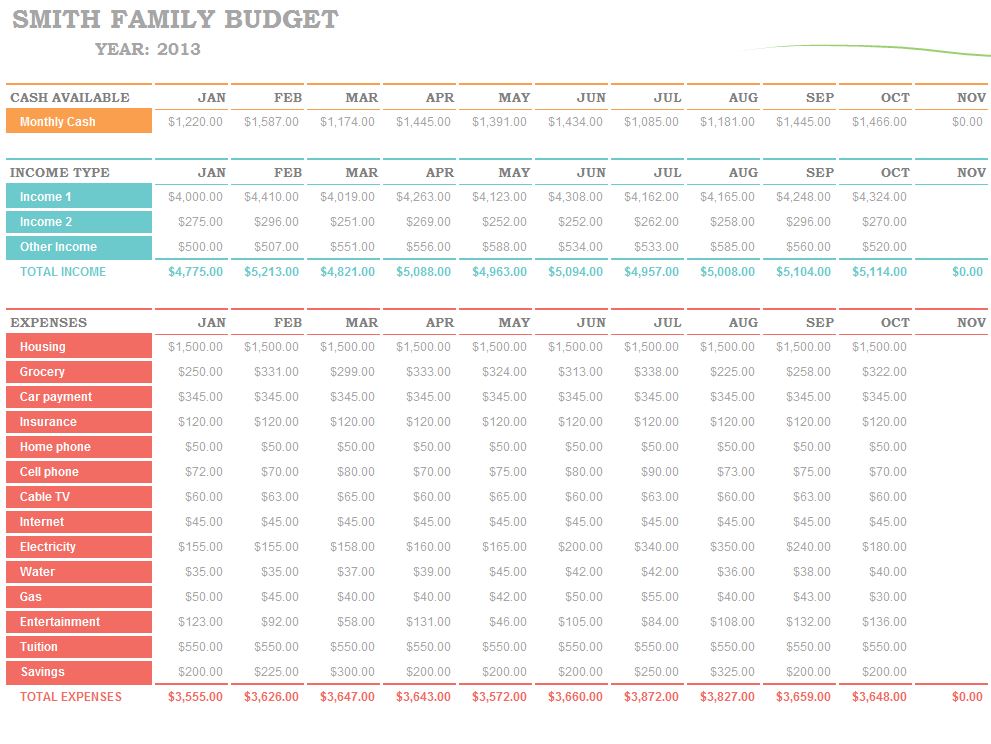

Updated june 26, 2023. Bitcoin's rally continues, with the cryptocurrency hitting £45,000 for the first time in over two years. The first step to creating a monthly budget is understanding how you manage your money from day to day.

When it comes to taking care of your family in the present, and for the future, very few things are as important or as far reaching as your family finances. How to create and maintain a family budget. What is the average family monthly budget?

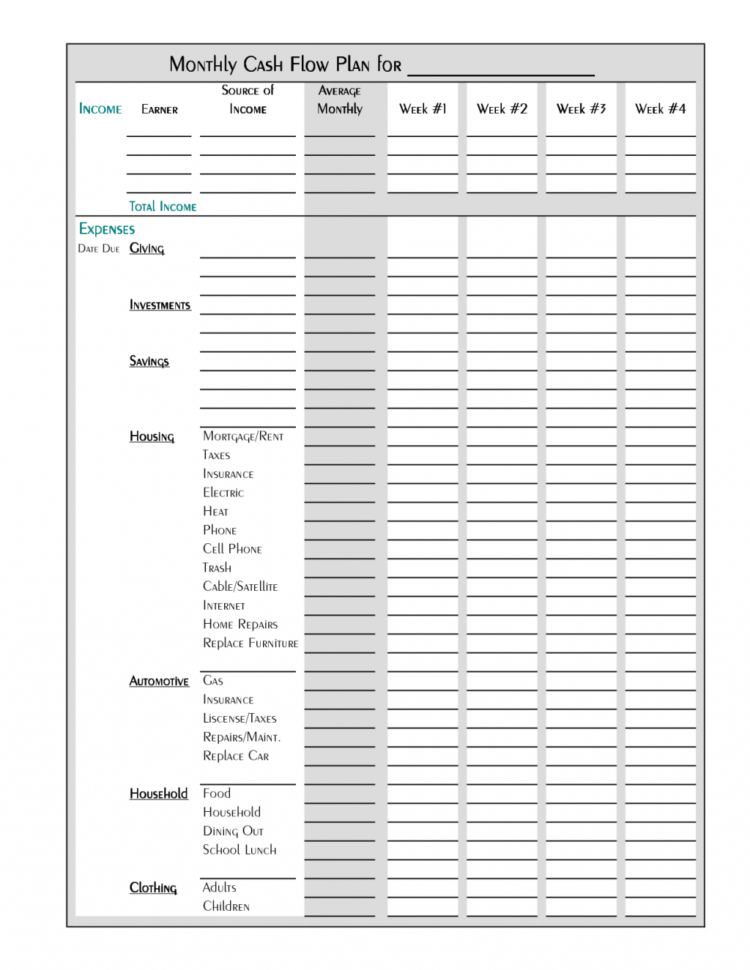

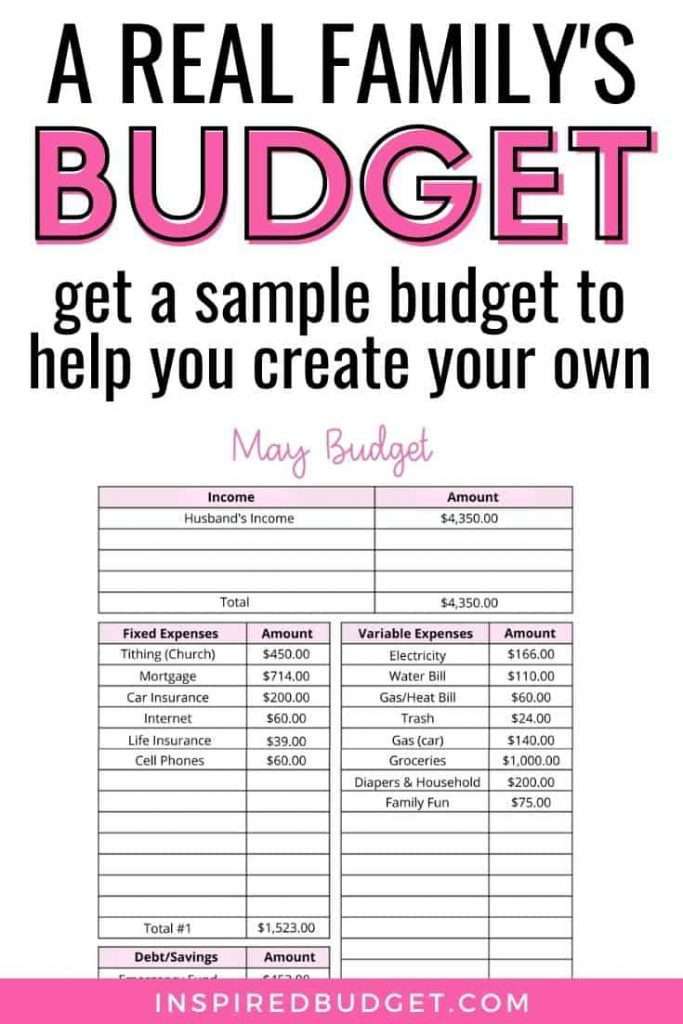

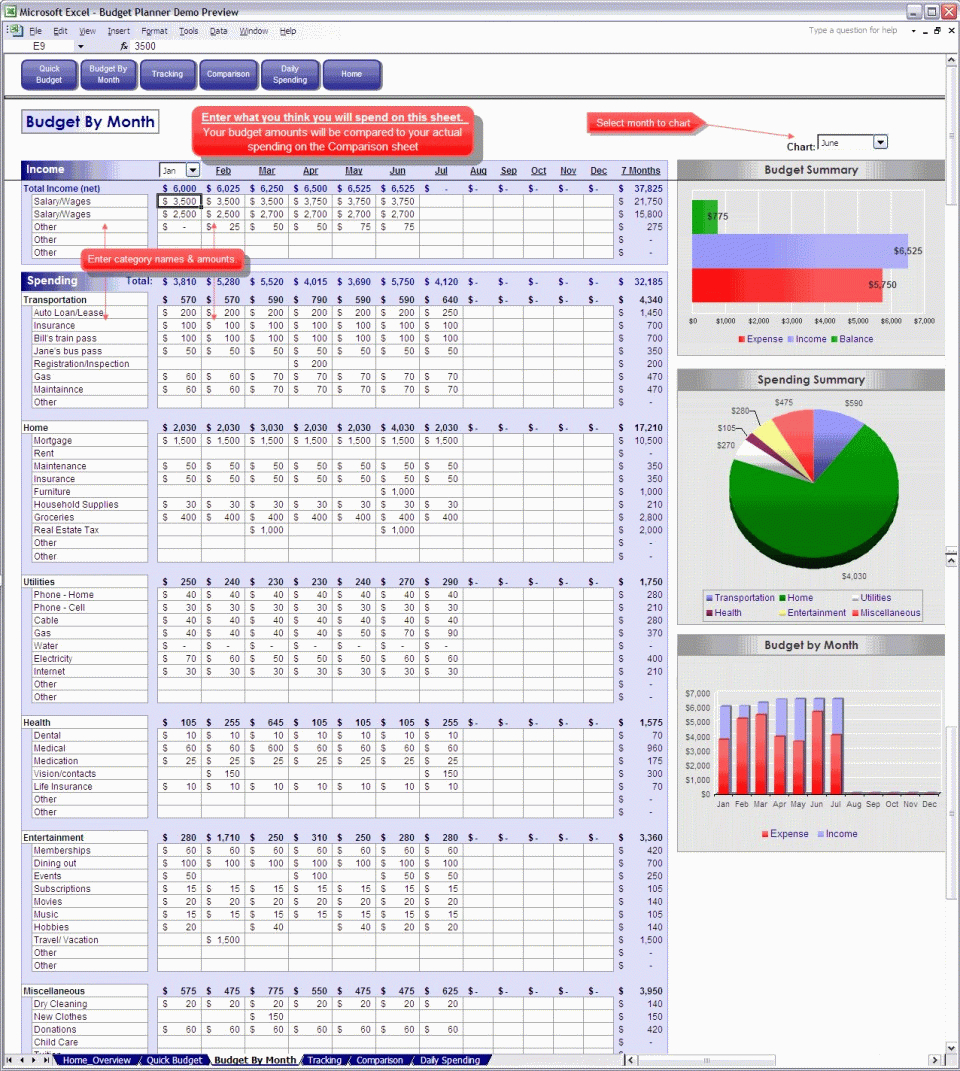

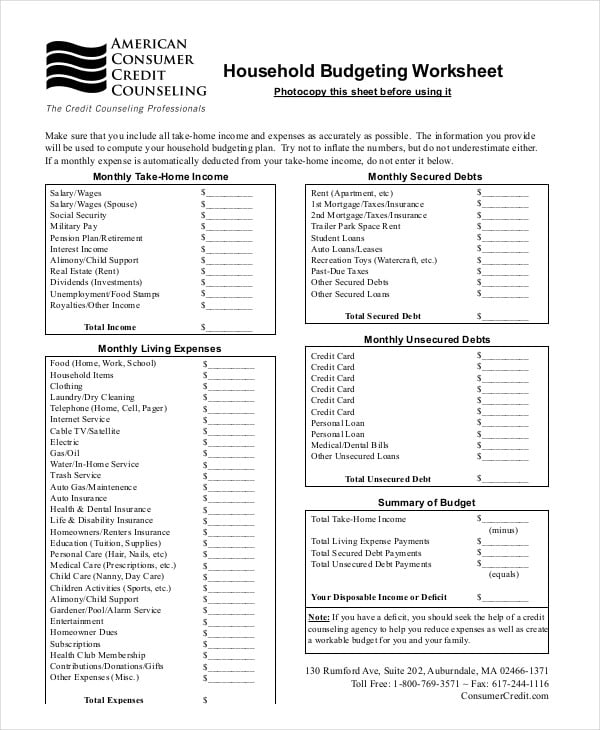

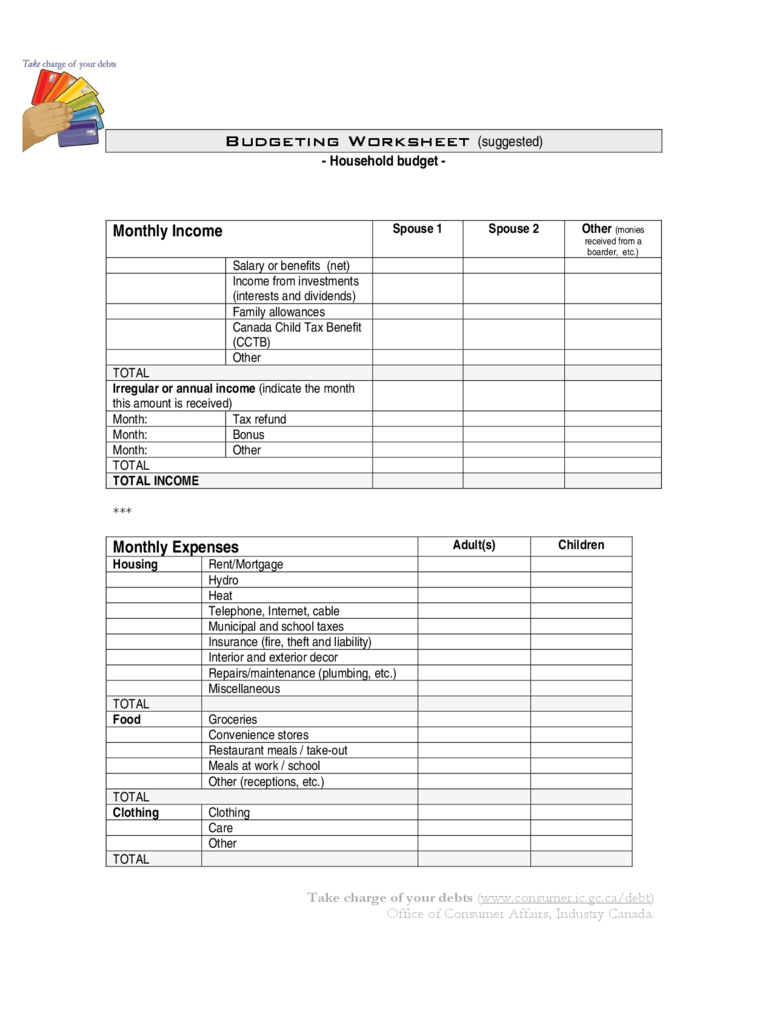

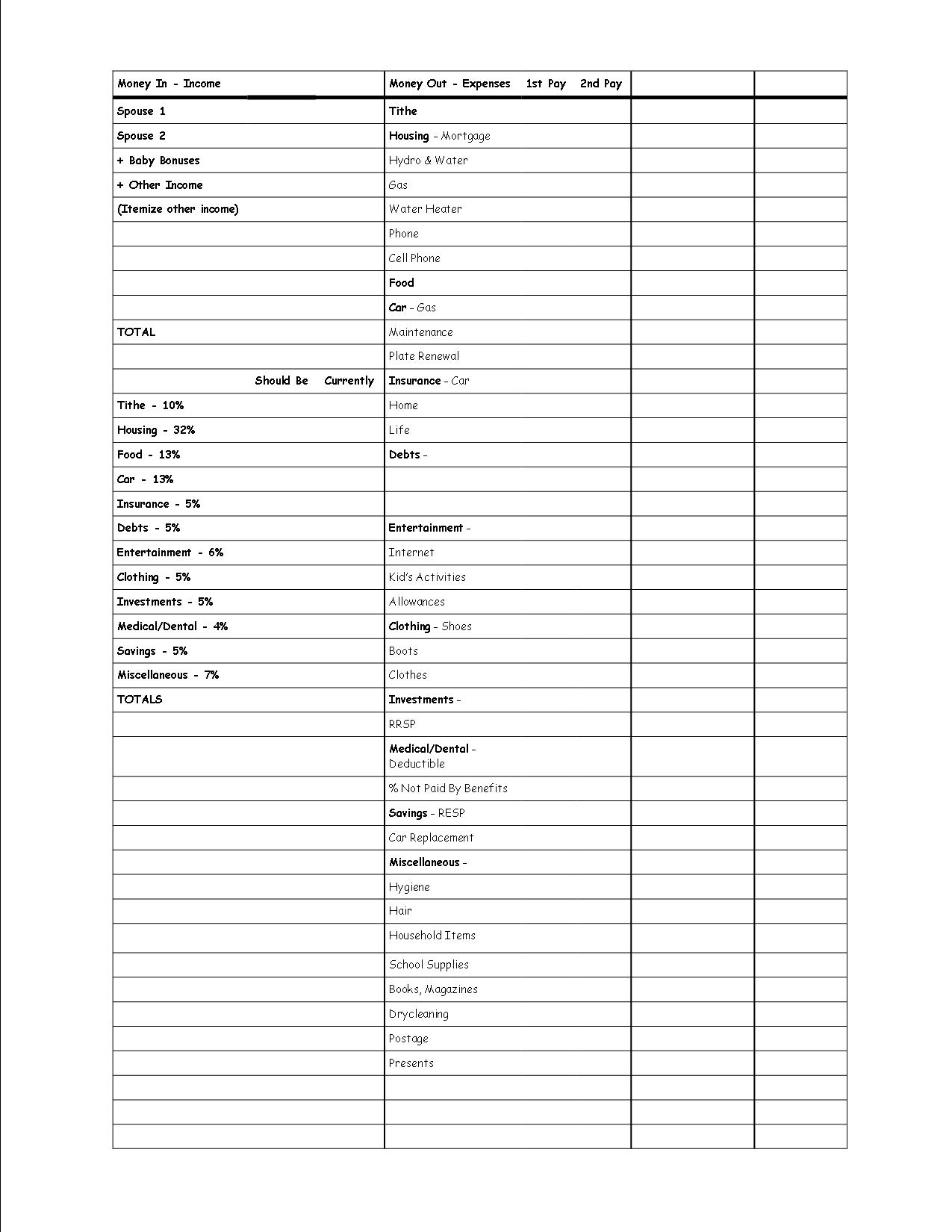

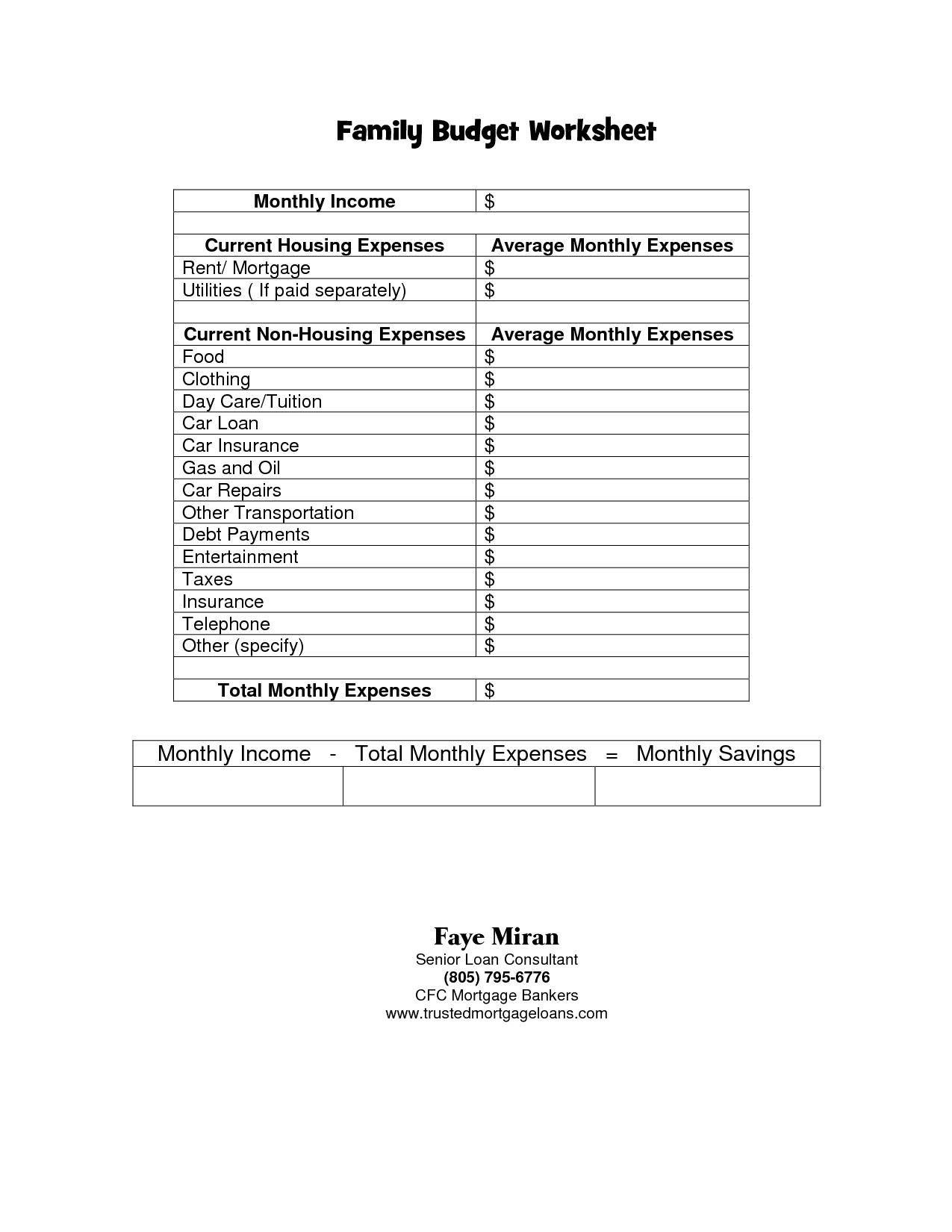

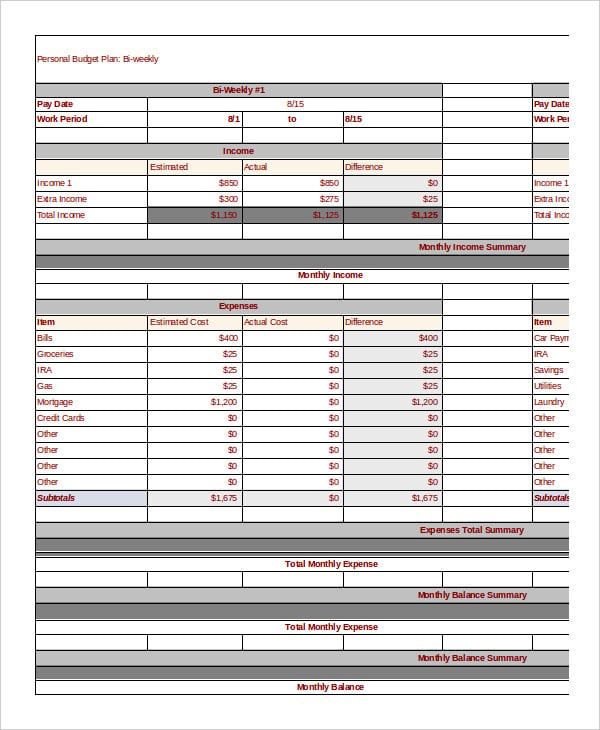

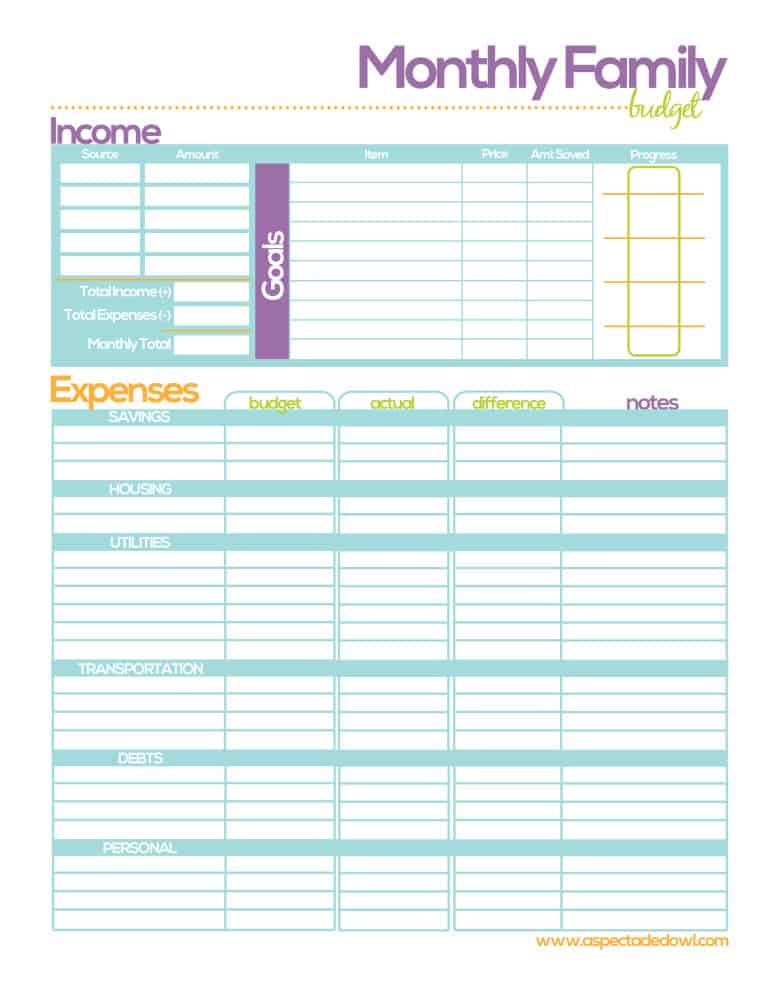

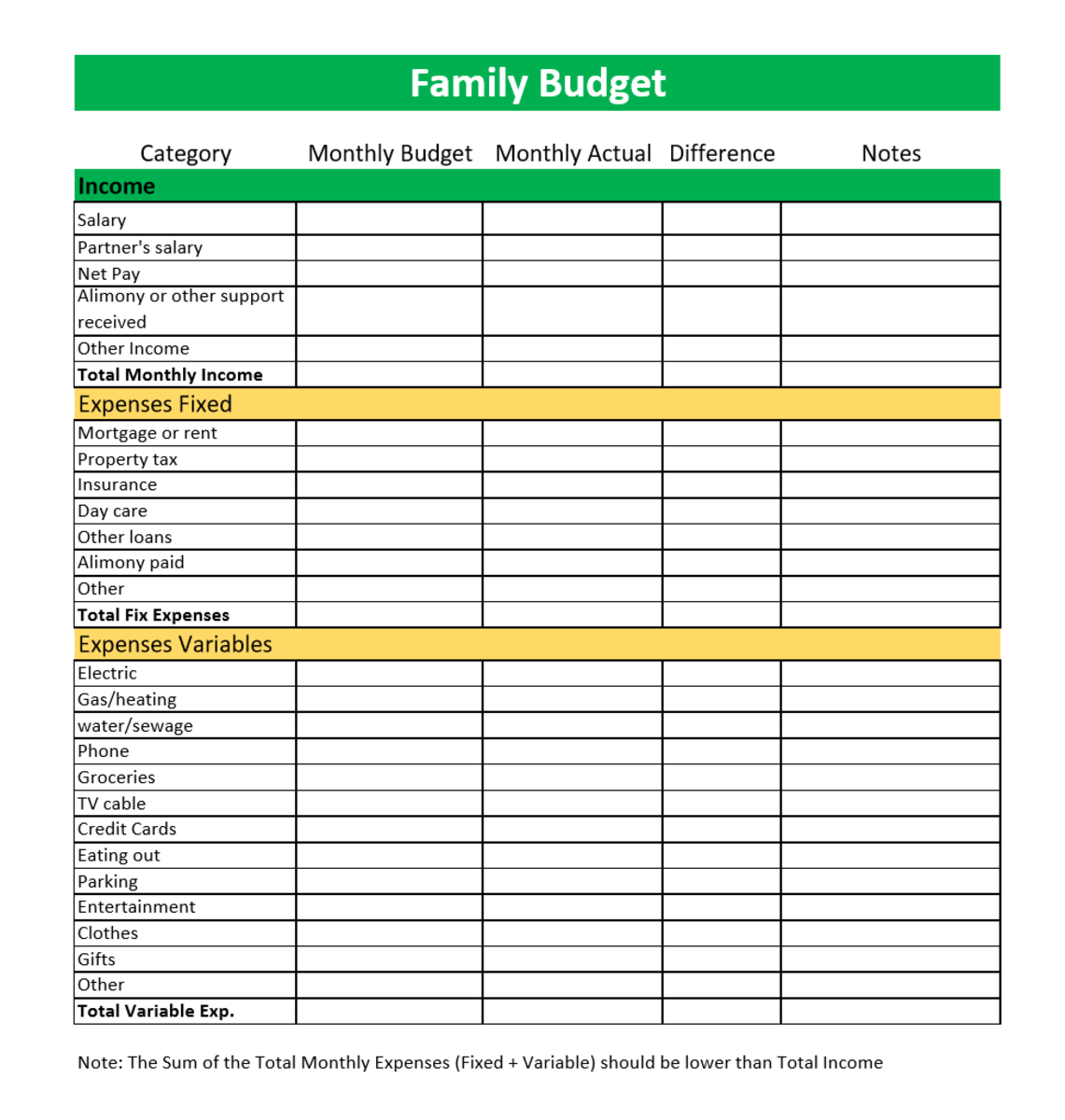

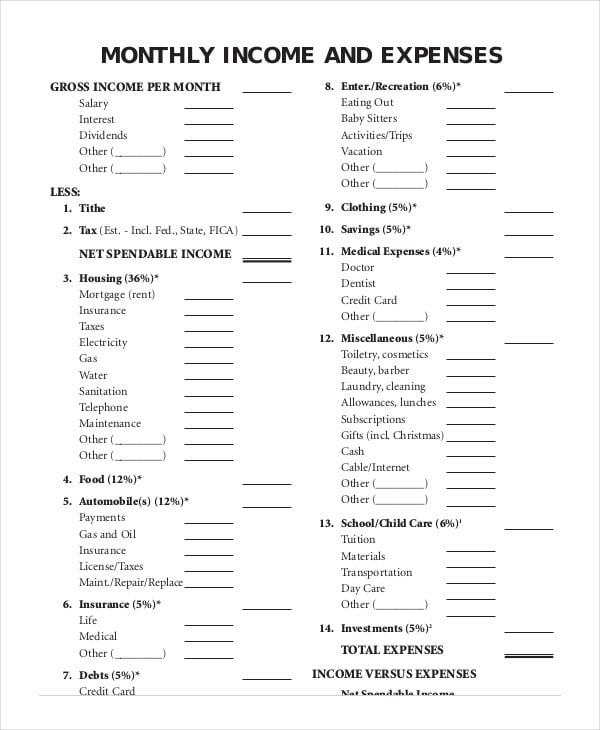

The 50/30/20 budget method puts 50% of your income for essential bills like insurance and mortgage, 30% into fun or luxury spending, and 20% into savings or. [2] you can use a simple pen and paper but it is much easier to use a. Start by gathering up all of your financial info—things like income statements, bank statements, credit card statements, and bills.

It's not just about recognizing your monthly paycheck; Build a bright financial future with a budget for your. Write down every penny that comes into your household.

Using a worksheet or application. By jenn sinrich. List your expenses and streams of income.

Determining your income and expenses. Whether you are struggling to make ends meet, wanting to pay off debt or saving for the future, drawing up a family budget is the best way to manage your. Simple family budget plan strategy.

Read this and more in the money blog, your place for consumer and economic. Understanding what a family budget is and the fundamentals of the. Identify all income sources.

How to create a family budget: Slash spending, boost savings and pay off debt by creating a realistic budget. When it comes to managing your family’s.

Every budget should align with specific financial goals. Lay the groundwork by compiling these financial records, as well as info on credit card debt, pension. Before sitting down to make a.