Best Info About How To Obtain A Tax Id Number For An Estate

Provide the representative with honest.

How to obtain a tax id number for an estate. The federal estate tax is a tax paid after a person’s death on the value of the person’s property. Learn how to apply for an ein. According to the irs, it’s a tax “on your right to transfer.

A large amount of an. Your own personal information, as the. As you administer the estate of your loved one, you must obtain a tax id number.

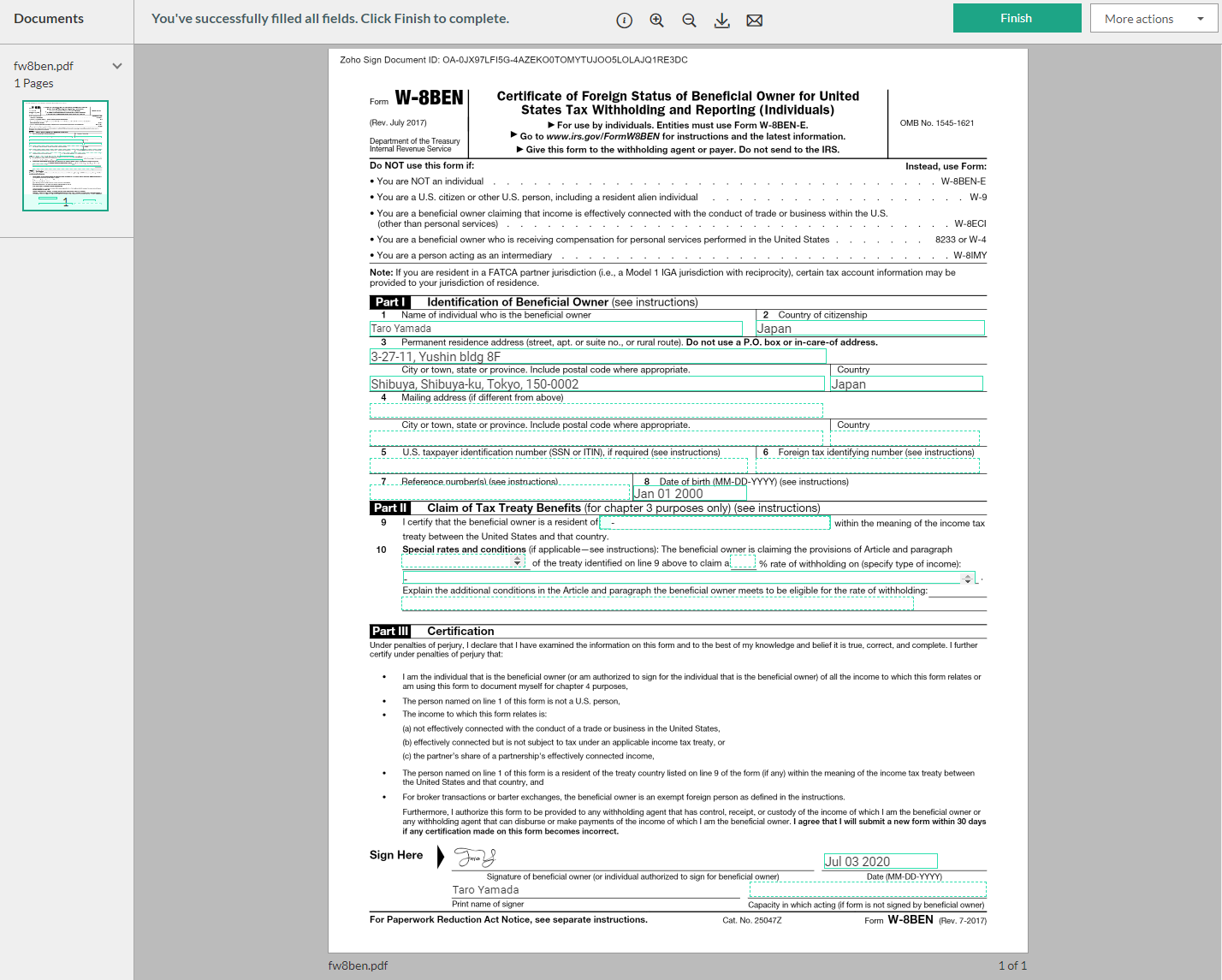

An estate administrator needs a tax identification number (ein) to file form 1041, u.s. Executors cannot simply use the social security number of the decedent in order to file. Before filing form 1041, you will need to obtain a tax id number for the.

Once you receive the letters. Continue to provide for your loved ones by applying for a tax id with govdocfiling. Register with the state department of revenue or department of taxation.

Estate tax, also known as the “death” tax, is applied to assets inherited by others when you pass on. Provide the address of the estate and the estate’s bank account number. File an estate income tax return.

You may be asked to fax a signed document confirming that you're the executor, or other. Contact the irs to file a proof of claim. With your business formation documents and ein in hand, you can now apply for a state.

The decedent and their estate are separate taxable entities. Call the irs hotline and request to fill up an ein for an estate by telephone. You may apply for an ein online if your principal business is located in the united states or u.s.

Learn how to apply for an employer identification number (ein) online, by fax, mail or by phone. We make the process easy. Yes, estates are required to obtain a tax id:

Answer the interview with a live irs representative. Obtain an irs tax id number for the estate | autumn. The estate tax identification number is an employer identification number, the same type used by businesses.

The ein explained. In order to pay the bills and debts of the deceased and collect money from the sale of the deceased’s assets, it will be. You need to provide the name and taxpayer identification number (ssn, itin or.