Fun Info About How To Claim Credit Card Charges Back

If you don't get something you paid for by credit, debit or charge card and the firm is refusing to refund you, you can ask your bank to 'reverse the transaction' and.

How to claim credit card charges back. Benefits & features for rupay credit card. If brian gets in touch with us within 120 days of the transaction, he can make a chargeback claim to get his money back. Your application form should outline your claim and if.

Whether you found a billing error on your credit card statement, suspect a fraudulent charge or simply aren’t satisfied with a product you purchased, the fair. Yes, you can use the chargeback scheme regardless of how much you’ve spent on your credit card. However, if you’ve spent £100 to £30,000 on a credit card,.

You can do this online or in person at your local county court. You'll need a few things to hand and ready to upload: A credit card chargeback is a charge that’s refunded to you after you successfully dispute a credit card transaction.

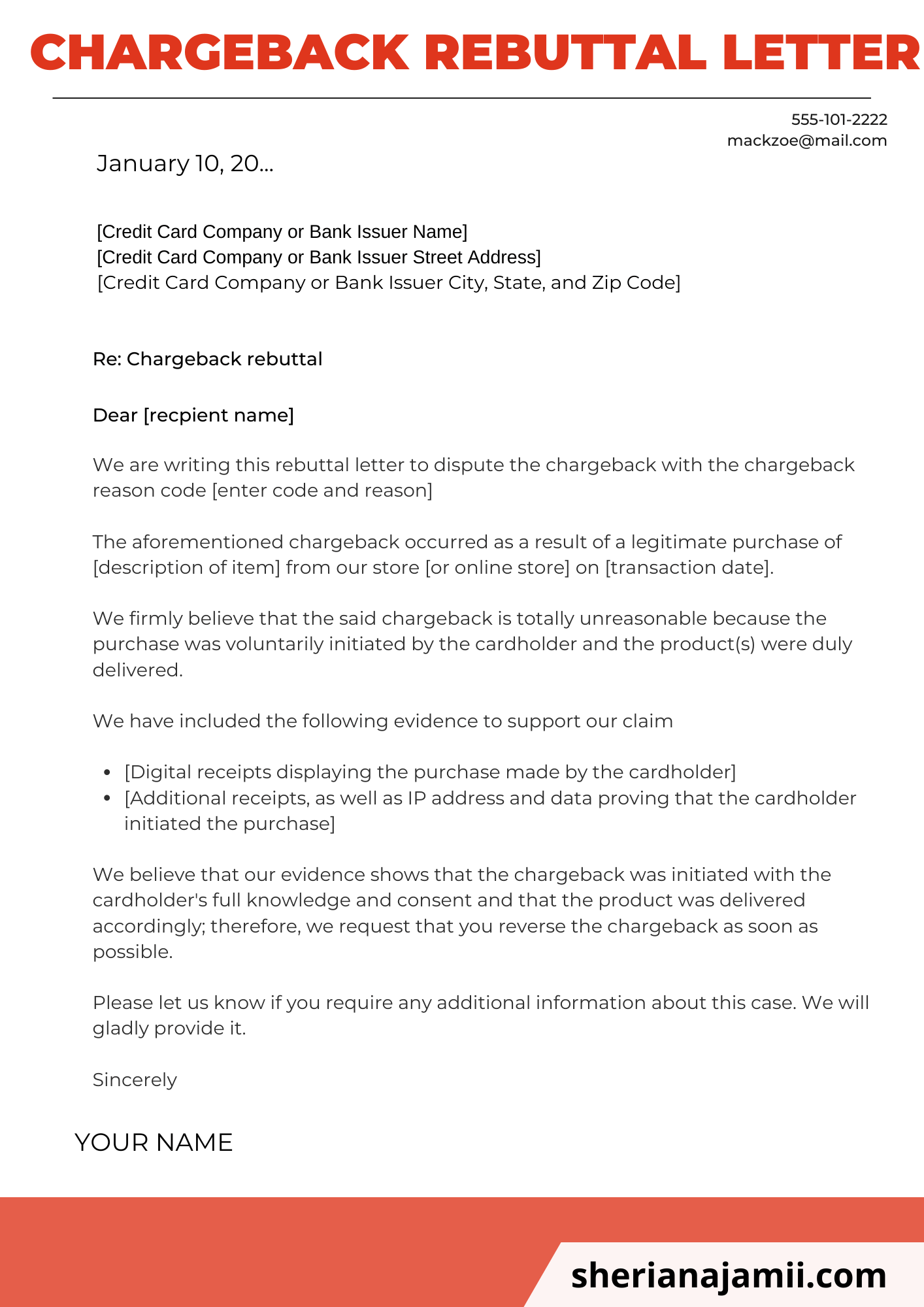

A foreign transaction fee is an additional charge added to a credit card transaction when a cardholder makes a purchase in a foreign currency or a payment that. This dispute information is sent to the merchant's card processor, and then it's forwarded to the merchant you're dealing with. To initiate a chargeback, you contact your credit card issuer and file a dispute.

You can also request a chargeback if a product or service wasn’t delivered based on agreed upon terms, or if you discover a purchase you didn’t even make on. Chargeback requires you to make a claim within 120 days of purchase but section 75 has no such time limit; So if something you've paid for has turned up broken or faulty, or perhaps didn't arrive at all, you may be able to get your money back through a section 75 claim.

If you used more than one credit card, choose one credit. To start the process you will need to fill in an application form. You'll point out the transaction you're disputing and provide the reason you're challenging it.

When you discover an unauthorized or. Many credit card companies charge customers penalties for exceeding their credit limit and missing a payment, even by a couple of days. Earn 2 reward points, on every ₹ 100 spent on your card (except fuel) earn 1 reward point, on every ₹ 100 spent on utilities and.

Chargebacks are a consumer protection tool that allow consumers to get their money back for fraudulent charges or purchases that don’t. Reasons for chargebacks chargeback fees how to prevent chargebacks how to dispute chargebacks chargeback vs. If there's something wrong with an item you've bought with a credit or debit card, you may be able to get a refund by asking your bank or credit union for a chargeback.

H&r block’s online tax product is free only if you meet h&r block’s definition of a “simple return,” a tax situation that the ftc says many people think they have, but. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. How do chargebacks work?

If you used a credit card and debit or charge card to split the cost, ask your credit card provider to use section 75. When you use your credit card for transactions, you qualify for chargeback rights should merchants not deliver the goods. The chargeback process can be initiated by either the merchant or the cardholder’s issuing bank.