Wonderful Info About How To Buy Futures In Oil

Direct investment in oil futures investors can purchase oil futures contracts, which give them the right to buy or sell a specific amount of oil at a.

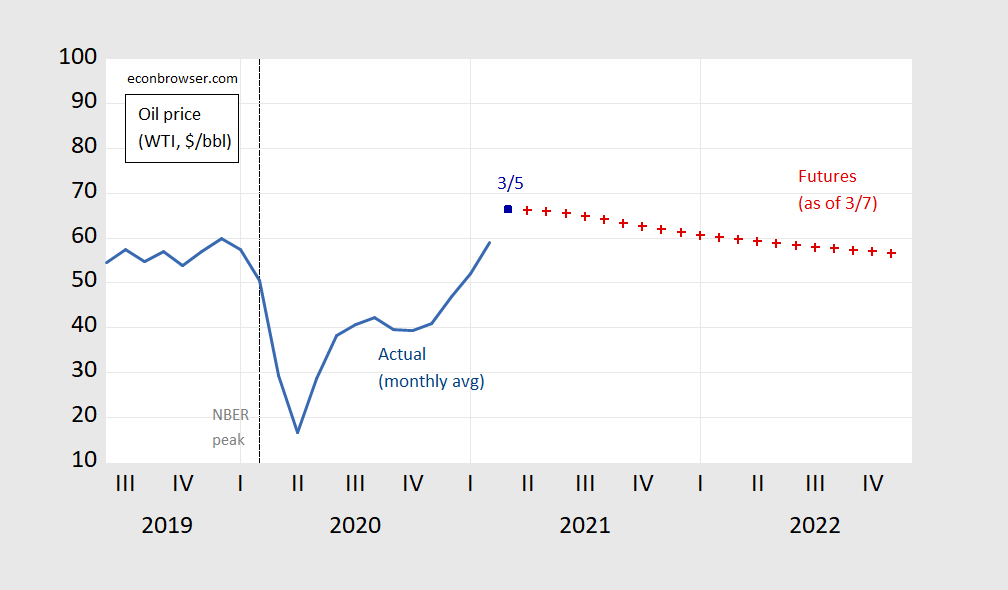

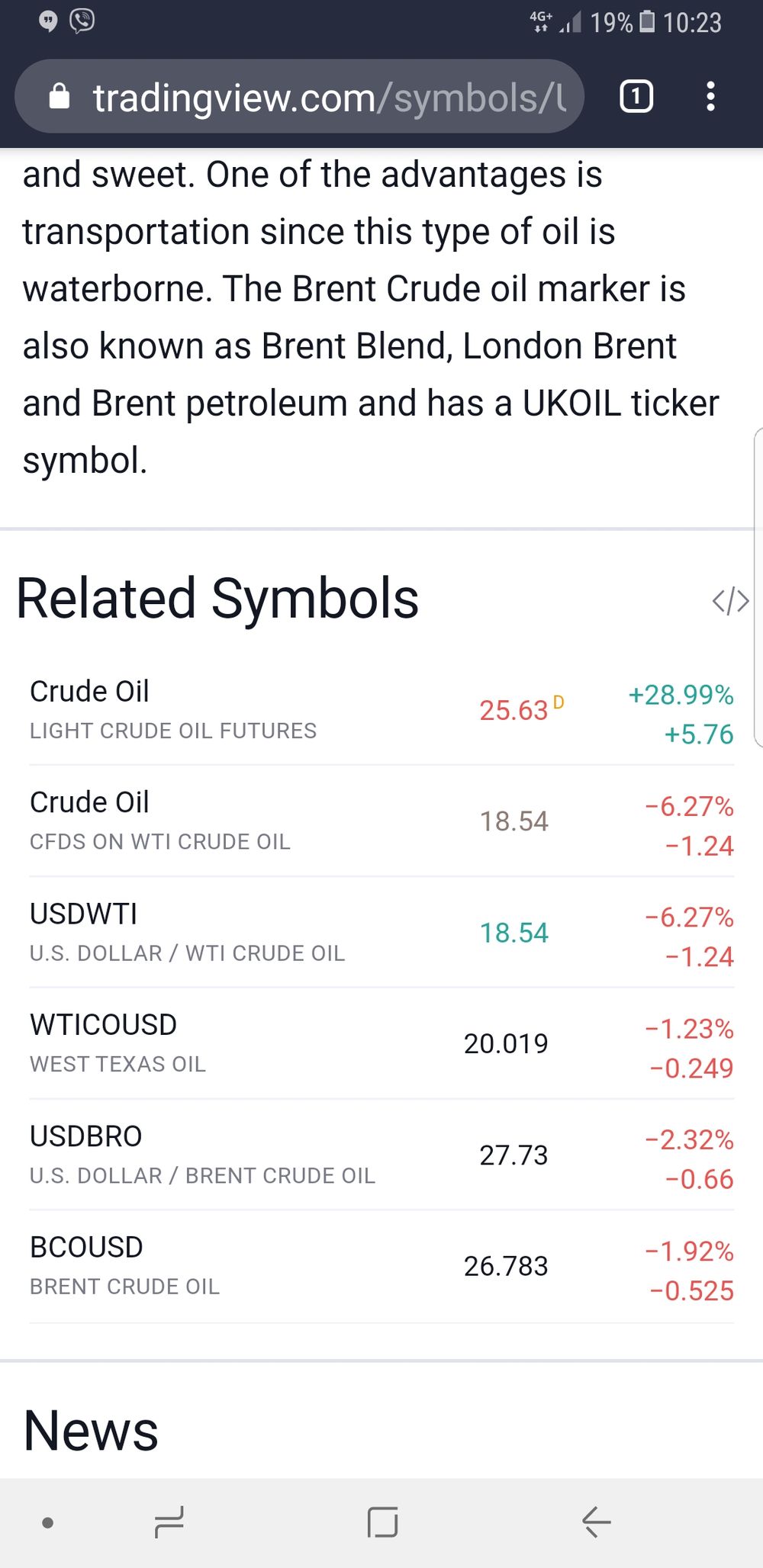

How to buy futures in oil. Futures contracts are agreements to buy or sell a standardized amount of an asset at a specific price on a specific future date. Wti and brent futures contracts. In this case, the asset is crude oil.

Oil etfs offer a way to invest in oil without buying and selling futures. Understand the basics of oil trading. They're options on futures, offering the investor certain advantages over oil futures.

Sto) and woodside energy group ltd ( asx: Crude oil options are widely traded energy derivatives, but with a twist. What are the pros and cons of investing in oil futures?

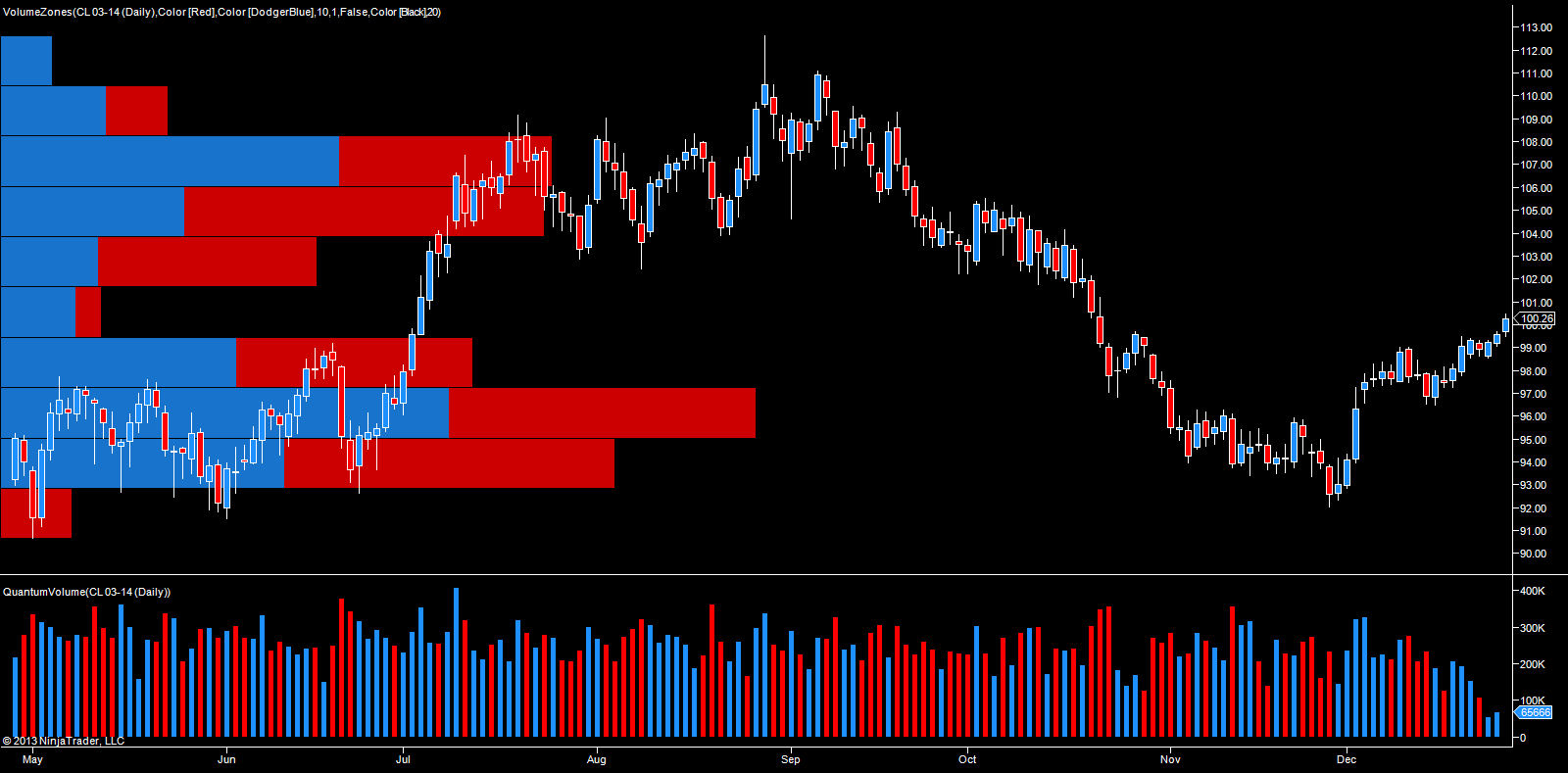

Here we define wti and brent oil futures trading and cover the. Choose your preferred method of trading oil. When you trade a futures contract, you must either buy or sell—call or put—the commodity by the expiration date at the stated price.

Crude oil futures fell slightly wednesday as the. This article will provide a. Live charts, historical data, futures contracts, and breaking news on wti prices can be.

Futures are the most direct way to purchase this commodity without literally purchasing barrels of oil, but they’re a more advanced and complex. If you want more experience with the futures market. Create your demo trading account.

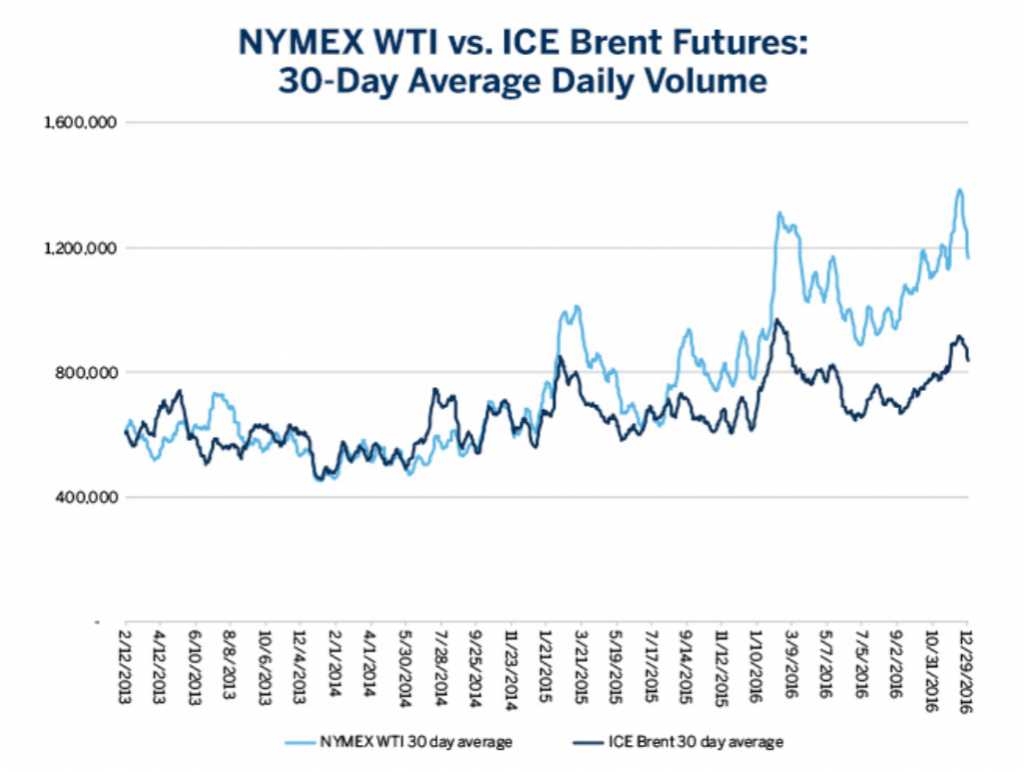

However, you can trade more than just nymex crude oil. Crude oil storage tanks are seen from above at the cushing oil hub, in cushing, oklahoma, march 24, 2016. Find out how to trade oil futures.

While companies focused primarily on fossil fuels may not appear well. The current price of west texas intermediate (wti) crude oil today is $79.29 per barrel. Perhaps the most popular, though, is.

There are lots of reasons for investing in oil etfs. Crude oil futures are 1,000 barrels per contract, traded from 6:00 p.m. You can trade crude oil futures on our affiliate platform futuresonline.

Oil futures are a common method of buying and selling oil, and they enable you to trade rising and falling prices. If you hold a call, the. Oil and gas stocks have historically shown significant capital gains and attractive dividend income during periods of high oil prices.