Painstaking Lessons Of Tips About How To Buy A Pension

How do you invest for retirement when you have a pension?

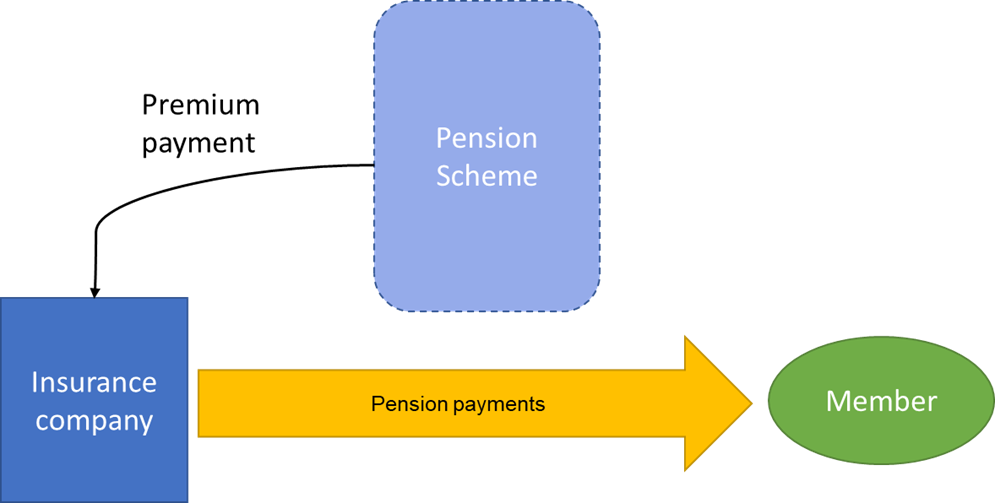

How to buy a pension. Johnson & johnson ( jnj ): Pension providers will usually offer a range of investments and some. Usually, the money to buy an annuity comes from a person’s pension pot, but you can use money from any source, such as savings or.

What is the best way to invest a pension lump sum? Deciding whether to buy an annuity is just the first step. The level of prescription peaked in 1977.

The fund is expected to be trialled from this march. European countries are some of the best places for pensions in the world, analysis shows, and ai is having an increasing impact on how each system works. It is possible to shop around yourself, and you can use our annuity comparison tool to search the annuity market to help you see how much income you.

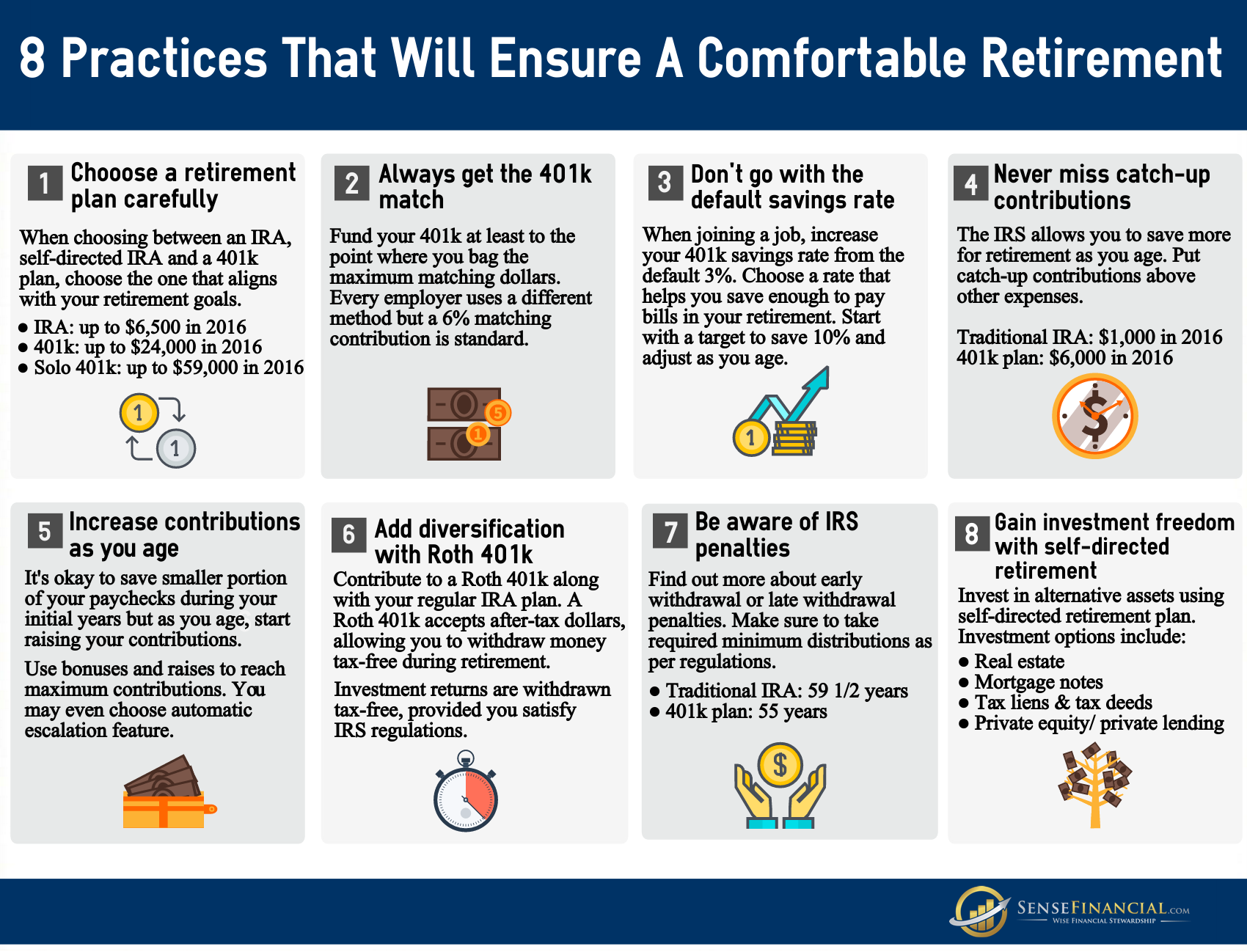

Delaying the start date of when you. Many retirees who would benefit from annuities. Our money guy guidelines suggest investing 25% of your gross income for retirement, but it can be.

Pension funds were forced to invest a percentage of their assets under management in government bonds. Forecast the value of your future pension pot with profile pensions. Buying an annuity is usually.

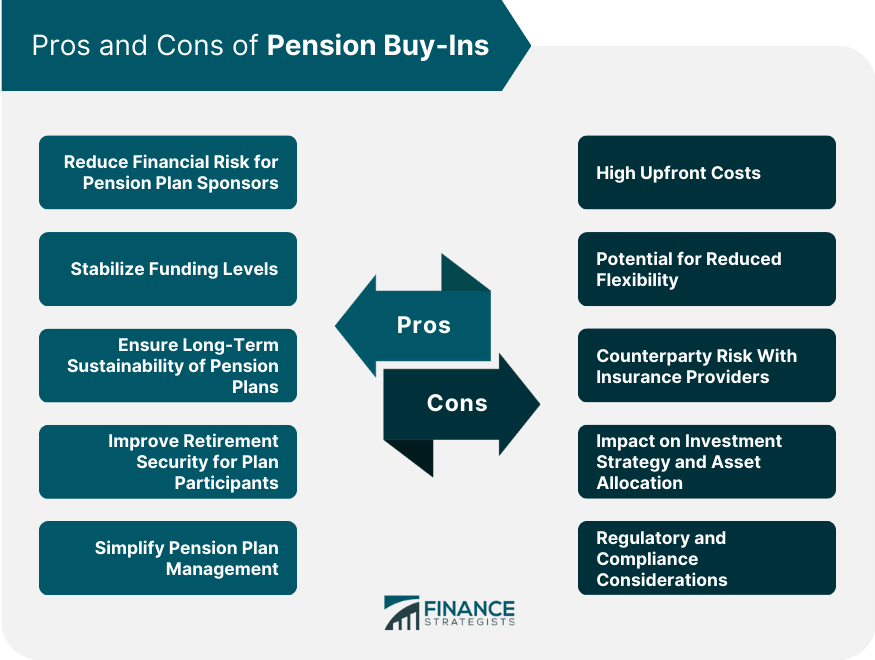

Carefully consider the risk your pension may change, be bought out or, worst case, go bankrupt. Three large companies could use their pension plans to save money. When you retire, you can use your own savings, such as money in a 401(k) plan or ira, or savings that are not in a retirement plan, to buy an immediate annuity, which would pay you a guaranteed income for the rest of your life.

This gives you a regular guaranteed retirement income for the rest of your life or for a fixed term. The company charges consumers too much for its drugs. (mayofi/ pexels) by tara o'connor.

Here are three ways to boost your cpp pension in 2024. A guaranteed investment certificate, or gic, is an investment plan where investors can earn interest. In this way, you can create your own pension.

The uk private pension market is quite competitive, with a range of providers offering a variety of products and services. As a result, choosing the right. See your projected pension pot at retirement with our handy calculator.

But employees can opt out of. To learn how to buy an annuity, follow these eight steps. If you are concerned about the financial viability.